Charities Aid Foundation (CAF)’s payroll giving scheme has raised more than £1.6bn for good causes since it launched in 1987, latest figures have revealed

Its Give As You Earn scheme has supported more than 40,000 charities for more than 2,.000 clients and their staff, says CAF.

Payroll giving involves donations taken from employees’ payslips before income tax is deducted. This means that every £25 donation effectively costs the worker £20. The schemes also often involve matched contributions from employers.

CAF’s figures also show that more than £110m was donated to charities through its Give As You Earn scheme during the last financial year, with £35m given by employees and £74m through tax relief.

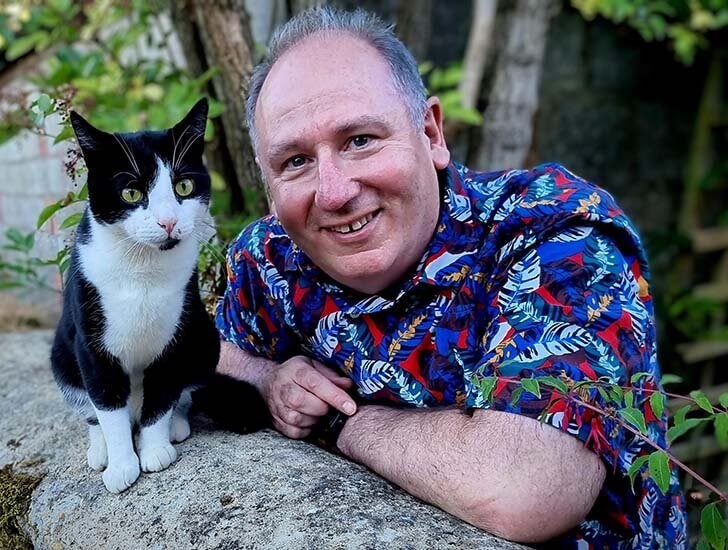

“We know from our research that employees want to work for a business that has a strong social purpose,” said CAF chief executive Neil Heslop.

“By matching donations, businesses can put their social purpose into action and contribute more to good causes which are important to the people that work for them.

“As businesses and individuals have become more socially minded, payroll giving has also become to a significant workplace benefit. It has also been shown to be a highly effective way to respond to humanitarian emergencies.

“In March for instance, we saw employees respond generously to help people fleeing Ukraine by signing up for payroll giving and increasing contributions, taking advantage of tax relief and employer matching.”

Latest News

-

MPs call on the Government to improve its support for small charities

-

Nicola Sinclair: How strategic charity partnerships drive meaningful change

-

Burnout fears emerge for younger charity workers

-

Youth charity to adopt co-leadership model

-

Mahnoor Khan: Lessons from my first year in the charity sector

-

Charities should deploy AI ‘around real user needs’ not ‘internal assumptions’, says report

Charity Times video Q&A: In conversation with Hilda Hayo, CEO of Dementia UK

Charity Times editor, Lauren Weymouth, is joined by Dementia UK CEO, Hilda Hayo to discuss why the charity receives such high workplace satisfaction results, what a positive working culture looks like and the importance of lived experience among staff. The pair talk about challenges facing the charity, the impact felt by the pandemic and how it's striving to overcome obstacles and continue to be a highly impactful organisation for anybody affected by dementia.

Charity Times Awards 2023

Mitigating risk and reducing claims

The cost-of-living crisis is impacting charities in a number of ways, including the risks they take. Endsleigh Insurance’s* senior risk management consultant Scott Crichton joins Charity Times to discuss the ramifications of prioritising certain types of risk over others, the financial implications risk can have if not managed properly, and tips for charities to help manage those risks.

* Coming soon… Howden, the new name for Endsleigh.

* Coming soon… Howden, the new name for Endsleigh.

Better Society

© 2021 Perspective Publishing Privacy & Cookies

Recent Stories